State of the Town: Multi-Million Dollar Budget Shortfall Projected

Potential budget deficits and questions surrounding Marblehead’s cash management took center stage at the Select Board meeting on Wednesday, February 1, 2022.

Significant Budget Shortfall Expected

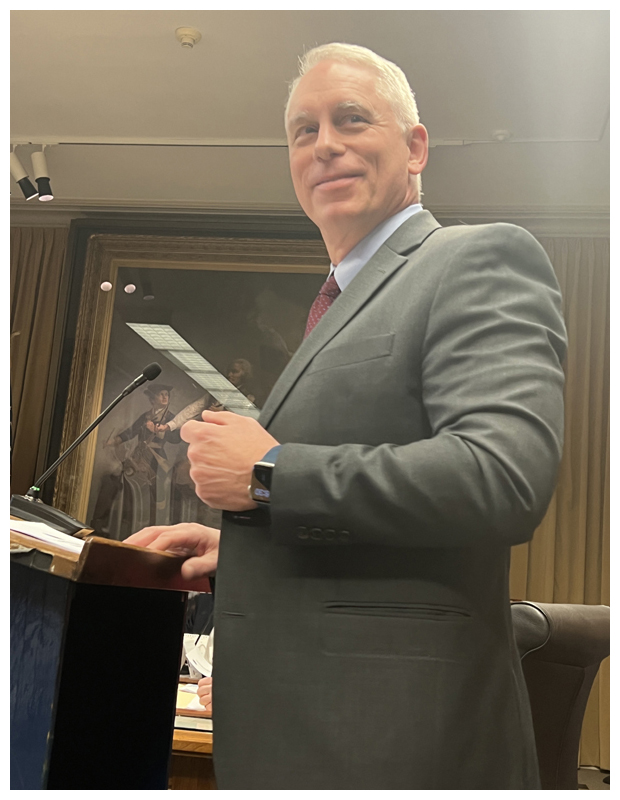

The evening began with an overview of the Town’s financial status presented by Town Administrator Thatcher Kezer. The primary take-away is that the Town is looking at a substantial deficit for fiscal year 2024, which begins July 1, 2023 and runs through June 30, 2024. Kezer said that he anticipated increased expenses ranging from three percent to six percent over the fiscal year 2023 numbers. If the actual increase falls in the middle of this range at four-and-a-half percent, a scenario Kezer considers “close to reality,” the Town would be facing a $3.1 million budget shortfall.

As a result, Kezer said, we are going to need to begin a discussion about “override scenarios.” The term “override” refers to Proposition 2 ½, a Massachusetts law that requires citizens to vote in favor of tax increases above and beyond the 2.5 percent maximum increase allowed each year. Kezer stated that “I have to have a real budget ready to go that assumes no override,” but he said that it is likely the Select Board will support some version of an override to be presented for approval to Town Meeting and potentially appear on the June 2023 ballot, with it still to be determined whether this tax increase would be focused merely on plugging the expected deficit or also on enhancing town services.

Select Board member Erin Noonan spoke following Kezer’s presentation, noting her concern that “peer towns require allocations to stabilization funds so they have a safety net and budgeting policies that would prevent us from getting, quite honestly, this far.” The Town, according to Select Board Chair Moses Grader, only established such a fund in 2018 and is in the process of funding it. Noonan also noted her concern about the short timeline now remaining to present a “vetted” override proposal to the taxpayers. Grader said that Town officials will have to work “like professional athletes” to accomplish that.

Missing Dates and Rates

Following Kezer’s State of the Town presentation, the conversation turned to cash management, a last-minute addition to the meeting agenda, seemingly in response to two recent Marblehead Beacon articles, the first of which reported on an investigation into millions of dollars of Town funds potentially being held in accounts paying significantly below-market interest rates while the second underscored the ongoing lack of response from Marblehead Town officials to Marblehead Beacon’s public records requests.

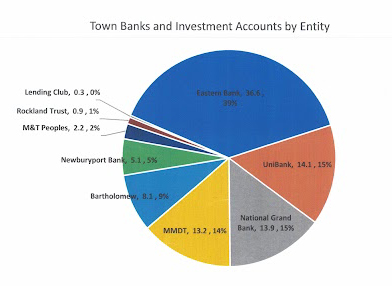

In the cash management presentation, Kezer displayed a pie chart, shown below, in which he depicted the breakdown of Marblehead Town funds ($94 million total) held at various banks. The pie chart did not specify a date range during which these funds were held, the interest rates that were paid, or what the cash represented (for example, trust funds versus routine transactional monies).

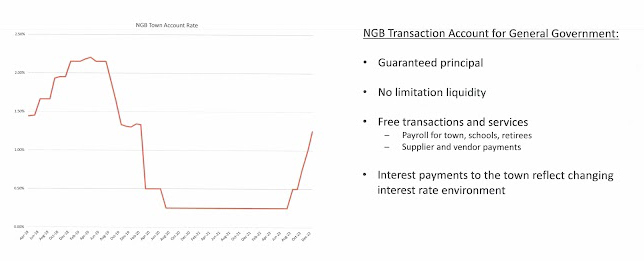

Kezer presented a second chart showing interest rates paid over time by one of the banks indicated–National Grand Bank (NGB)–demonstrating that the rates had fluctuated between 0.25 percent and 1.25 percent from mid-2020 through the end of 2022, and up to approximately 2.25 several years ago. According to the pie chart, $13.9 million, or 15 percent of the Town’s resources, were being held at NGB, although it is unclear during what time period.

As previously reported, Marblehead Beacon had earlier been told by Kezer that, as of December 6, 2022, NGB held $29.3 million, earning a one-percent interest rate on that date. Marblehead Beacon approached Kezer following the meeting to ask for clarification on the dates represented in the pie chart as well as the interest rates being paid. He replied that he did not have that information available and that it was hard to gather because “each bank has a different statement date.”

Grader Criticizes Marblehead Beacon Coverage

Although not referring to Marblehead Beacon by name, Select Board Chair Grader appeared to take issue with recent coverage of the town’s financial management, saying that “part of what we’re attempting here is to present a broad context for something that had come up in one of the papers.” He emphasized his enthusiasm for transparency, public records requests, and reporters “com[ing] in to talk to us,” and added that “it is crucial, I think, if you’re going to do good investigative reporting that you compare apples to apples, you don’t cherry-pick time frames, and you really drive your analysis with a full understanding of the context.”

Marblehead Beacon’s Lena Robinson responded during the public comments portion of the evening, noting that repeated requests for information to provide additional context had–for more than thirty business days–gone unanswered by the Town administration and members of the Select Board. She also noted that the purpose of the repeated requests to see multiple months of interest and average daily balances were, in fact, made precisely for the purpose of avoiding cherry picking.

While Grader suggested that “the way we attempt to conduct ourselves is that we have nothing to hide and we’re completely open to discussions,” Robinson pointed out that, with respect to the pie chart Kezer presented, “I don’t believe there are interest rates on there. I don’t believe there was a date, so for all I know all this money was transferred this morning.”

Grader also seemed to suggest that Marblehead Beacon’s reporting failed to take into account the fact that “there’s different types of accounts [and] transactional accounts specifically are designed and constrained by liquidity and guarantees that are completely different.” Robinson responded by noting that there are transactional accounts that are fully liquid and are paying significantly higher interest rates than the town appears to have been earning. For instance, she noted, the Massachusetts Municipal Depository Trust (MMDT), “is meant to be a transactional account [that] provides interest.”

Public Frustration Mounting

The evening concluded with additional public comments. School Committee Chair Sarah Fox noted that she had “heard from [former Town Administrator] Jason Silva three years ago that we are no longer cutting fat, we are now cutting flesh and bone” and expressed her concern that, without additional resources, “the impact of what I saw is terrifying for our individual departments.”

Bret Murray–previous member of the Select Board–expressed his concern that we have known this budget shortfall was coming for many years yet failed to act proactively, and “time is not on our side right now.”

Becca Whidden spoke about the accounts included in the pie chart, stating that “I would love to know, what was the time frame of that? We are getting cross information that really doesn’t square up with this idea of transparency.” She continued, “[t]he miscommunication is not helping anyone, and so I think responding to journalist questions would probably be helpful.”

Jim Full expressed incredulity that no one could go online and tell him how much interest was being paid on any of the accounts in which Marblehead Town funds were being held. We now live in a “one-click world,” he said, noting that he can easily get information from his own bank on interest rates, and he did not understand why the Town couldn't do the same.

Megan Sweeney noted, “I think there are a lot of people in the audience, a lot of people I’ve talked to, who are growing weary with the perpetual surprise, every year, that we are in a dire financial situation.” She continued, “It shouldn’t be February that we decide that perhaps we should have an override….How is Thatcher [Kezer] going to put together a reasonable argument to bring to Town Meeting to pass an override of any kind?”

Finally, Allen Waller stood up to question why the Town has not yet published its Comprehensive Annual Financial Report (CAFR) for fiscal year 2022, which ended in June of last year. These reports are typically available on the Town website, though as of time of publication, fiscal year 2021 was the most recent year posted, and that was only added after last Wednesday’s meeting. Waller noted that it is incredibly challenging to evaluate the fiscal year 2024 budget numbers when “the populace doesn’t know what happened in 2022,” and he is concerned because “we don’t want to be working with the wrong numbers.”

Next Steps

Following the meeting, Marblehead Beacon was able to schedule a follow-up discussion with Kezer and Grader that took place on Tuesday, February 7th. We also await the results of our appeal with the Secretary of State regarding the Town’s failure to respond to public information requests required by law. Please stay tuned for part three of our cash management investigation.